View the original article here: Is Malaysia’s chip sector prepared for the storm?

Is Malaysia’s chip sector prepared for the storm?

By LIEW JIA TENG | The Edge Malaysia | January 20, 2025

In the name of “US national security and economic strength,” the Biden-Harris administration on Jan 13 released an Interim Final Rule on Artificial Intelligence Diffusion. This rule imposes new restrictions on the export of US-developed chips that power artificial intelligence (AI) systems. The announcement comes just a week before Joe Biden exits the White House.

The new rule, which introduces a direct licensing framework for semiconductors used in data centres handling AI computations, has sent shockwaves through the global semiconductor supply chain.

Countries in the top tier, including Australia, New Zealand, South Korea, Taiwan, the Netherlands, and Ireland, face no restrictions. In contrast, nations such as China, Iran, Russia, and North Korea are effectively barred from importing AI chips from US companies.

The middle tier, which reportedly includes Malaysia, comprises more than 100 countries subject to export caps and licensing requirements.

The Semiconductor Industry Association (SIA) and Nvidia Corp — two powerful voices in the global chip industry — have strongly criticised the Biden administration’s new export curbs on AI chips.

“We’re deeply disappointed that a policy shift of this magnitude and impact is being rushed out the door just before a new administration takes office. This is not a meaningful triumph on the world stage,” said an SIA statement, adding that the rule remains unsubstantiated and ultimately fails to support national interests.

SIA and other American companies lamented the damage to America’s economy and global competitiveness in semiconductors and AI by directing strategic export bans on members, SIA President and CEO John Neuffer said.

Meanwhile, Nvidia CEO Jensen Huang decried the Biden administration for undermining the effectiveness of American AI chips. This, he said, reflects a step into more than a 200-page “regulatory morass,” “drafted in secret” and “without proper justification.”

“By attempting to restrict AI innovations and stifle competition — the lifeblood of innovation — the Biden administration’s new rule threatens to erode America’s hard-won technological advantage. While cloaked in the guise of an ‘anti-China’ measure, these rules would do nothing to enhance US security,” he warned.

Ready or not, the new rules have now entered a 120-day comment period, meaning they will take effect within four months from publication, giving the incoming Trump administration time to intervene.

It is anticipated that the Trump administration will give the green light based on feedback from experts, industry stakeholders and partner nations, potentially implementing changes based on their input.

For one, Nvidia CEO Jensen Huang had reportedly expressed readiness to meet Trump and offer his assistance to the incoming administration. He has not passed public comment on Biden’s regulation, arguing that the rule would reduce the distribution of US-based authentic components to much less useful ones.

While it remains to be seen how the shift will evolve in the new or the same administration, the current upheaval is already making waves in the chip industry.

And testament to America’s economic clout and domination of the semiconductor supply chain, according to Malaysia’s Ministry of Investment, Trade and Industry (MITI), “as the existing tech superpower, the country holds a monopolistic share in the AI chip market.”

Notably, Malaysia supplies some 23% of American chips, reflecting its strong ties with US firms. Therefore, maintaining investor confidence in the Malaysian semiconductor value chain and operations remains vital.

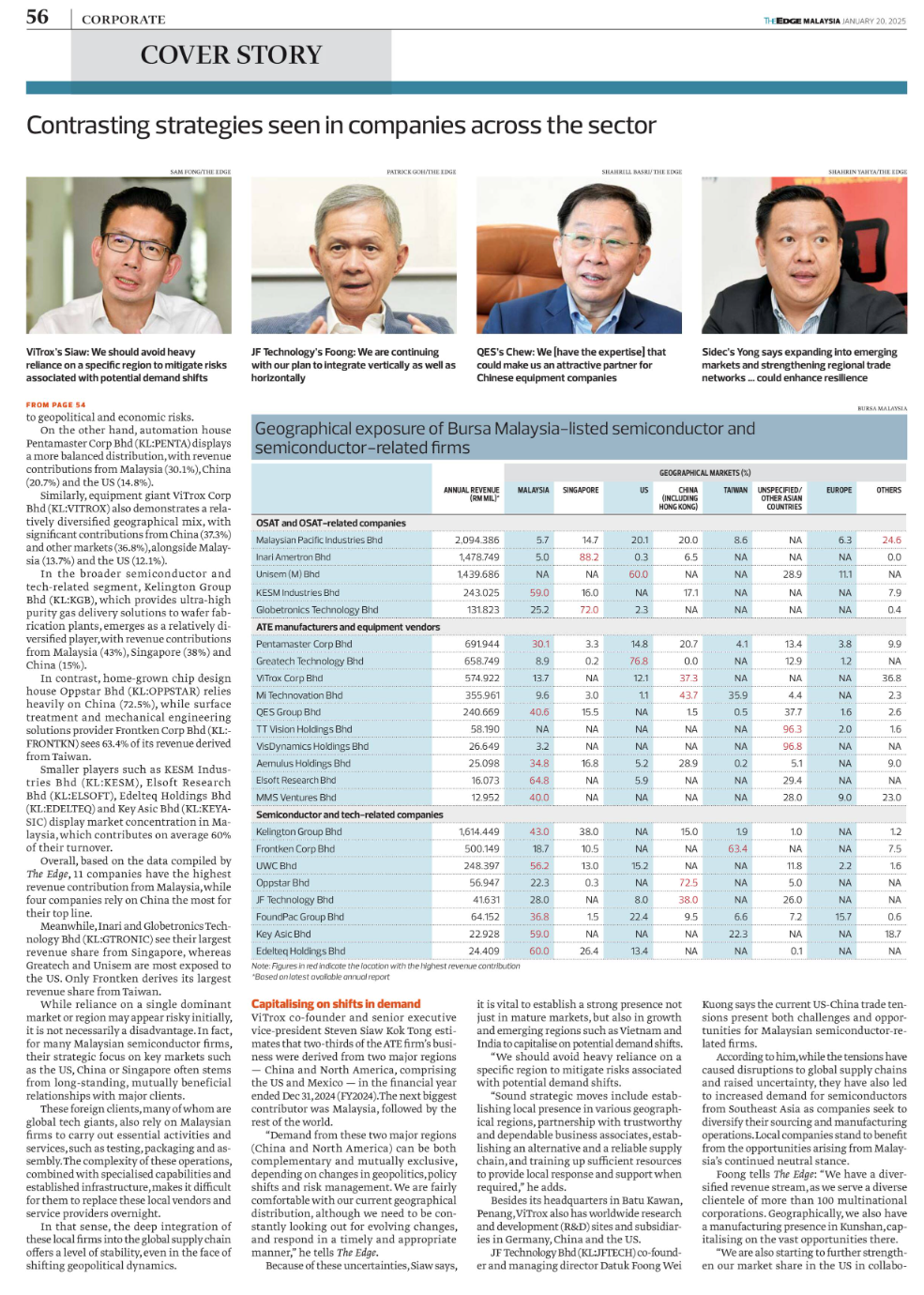

Malaysian players like Unisem (M) Bhd, Inari Amertron Bhd, and others with a more balanced geographical distribution appear better positioned to weather the current challenges.

Evaluating tech firms

When evaluating semiconductor companies listed on Bursa Malaysia, investors should carefully consider their geographical exposure, as it plays a pivotal role in determining their risk profile and growth potential, say market experts.

So, what are the critical metrics or factors investors should focus on?

Boutique fund house Tradeview Capital Sdn Bhd chief investment officer Nixon Wong Goh Tek Jye advises that geographical exposure is an important factor for investors assessing semiconductor firms because of the industry’s global interdependence and vulnerability to geopolitical and economic shifts.

In a nutshell, firms overly reliant on the US or China are vulnerable to trade tensions, sanctions and policy shifts, such as the US CHIPS Act or China’s export controls. On the contrary, a balanced geographical revenue mix reduces these risks.

“Companies with diversified regional portfolios are better positioned to withstand economic slowdowns or regulatory changes in any single region. Expanding into high-growth regions such as Southeast Asia or India offers potential for significant returns, though those markets come with higher risks,” Wong says.

Meanwhile, investors should also evaluate means to benefit from revenue concentration by region, avoiding firms whose revenues are concentrated in single-region countries where they are backed by strong diversification strategies.

“Customer base diversity is equally important. Investors should look for firms with a diversified customer pool to reduce dependency on a few key clients.

“Also, assess the number of locations for sourcing and manufacturing facilities. Where companies with multiple sourcing sites and regional manufacturing sites are less exposed to disruptions. Identify firms well-positioned in regions with strong, sustainable demand growth from areas such as China’s 5G rollout or Europe’s renewable energy (RE) transition,” Wong stresses.

He adds that investors should prioritise companies with diversified revenue streams, strong supply chain resilience, and broad alignment with regional growth trends. Local semiconductor firms should expand their direct market coverage in the US, China, India and Africa to unlock new revenue streams.

“Diversity into high-growth areas such as automotive semiconductors, Internet of Things (IoT) devices and AI accelerators, instead of focusing only on consumer electronics or 4G, AI should prioritise sensors and modules for RF and smart grids, along with global sustainability trends,” says Wong.

Vision Group managing director Chua Yee Leng says that Malaysian semiconductor companies rely on China for end-market demand and manufacturing.

“China is the largest consumer of semiconductor products for applications such as electronics, automotive and IoT. Our industry is providing China’s domestic tech ecosystem alternative supply-chain efficiency.

“On the other hand, the US remains a leading consumer for advanced semiconductor applications, including AI, 5G and automotive, and many Malaysian semiconductor companies benefit from the demand for OSAT (outsourced semiconductor assembly and test) and packaging services,” he notes.

In his view, geographical diversification for local companies “can best manage earnings volatility” to a certain extent when there is softer demand or shifts in end-user supply.

So instead of optimising only their geographical exposure, Chua believes a better strategy would be to achieve breakthroughs in technical advancements to focus on the more complex and technical semiconductor production.

“A successful transition towards and adoption of technology production requires close alignment and partnership between the public and private sectors.

“We in Malaysia are expected to present in the medium term a balanced portfolio with exposure to both superpowers offers a better strategy for Southeast Asian nations, including Malaysia,” he says.

As Malaysia aims to strengthen its position in the global semiconductor value chain, achieving balanced geographical diversification will be critical. Companies not reliant on single markets may need to recalibrate their strategies to mitigate risks and ensure long-term sustainability in an increasingly volatile global landscape.